In today’s fast-paced business world, efficient financial management is key to ensuring a company’s growth and sustainability. One of the most critical tools for achieving this is treasury management software. This technology has revolutionized the way businesses handle their financial assets, liabilities, and cash flows, providing a streamlined solution that enhances accuracy, reduces risks, and improves decision-making.

What is Treasury Management Software?

Treasury management software is a specialized financial tool designed to help organizations manage their cash flow, investments, and financial risk more effectively. It centralizes and automates various financial processes, such as cash management, liquidity forecasting, and payment processing. By integrating with other financial systems, it provides a holistic view of a company’s financial health, enabling better planning and execution.

The Importance of Treasury Management Software

For businesses operating in a globalized economy, managing finances manually is not only time-consuming but also prone to errors. Here’s why adopting treasury management software is a game-changer:

- Improved Cash Flow Visibility: With real-time data, businesses can track their cash flow across multiple accounts and regions. This visibility allows them to make informed decisions about investments and operational expenses.

- Enhanced Risk Management: Treasury management software helps identify potential risks, such as currency fluctuations or interest rate changes, and provides tools to mitigate these risks effectively.

- Automation of Routine Tasks: By automating repetitive tasks like payment processing and bank reconciliation, treasury management software frees up valuable time for finance teams to focus on strategic initiatives.

- Regulatory Compliance: Keeping up with ever-changing financial regulations can be challenging. Treasury management software ensures compliance by providing updated reporting features and audit trails.

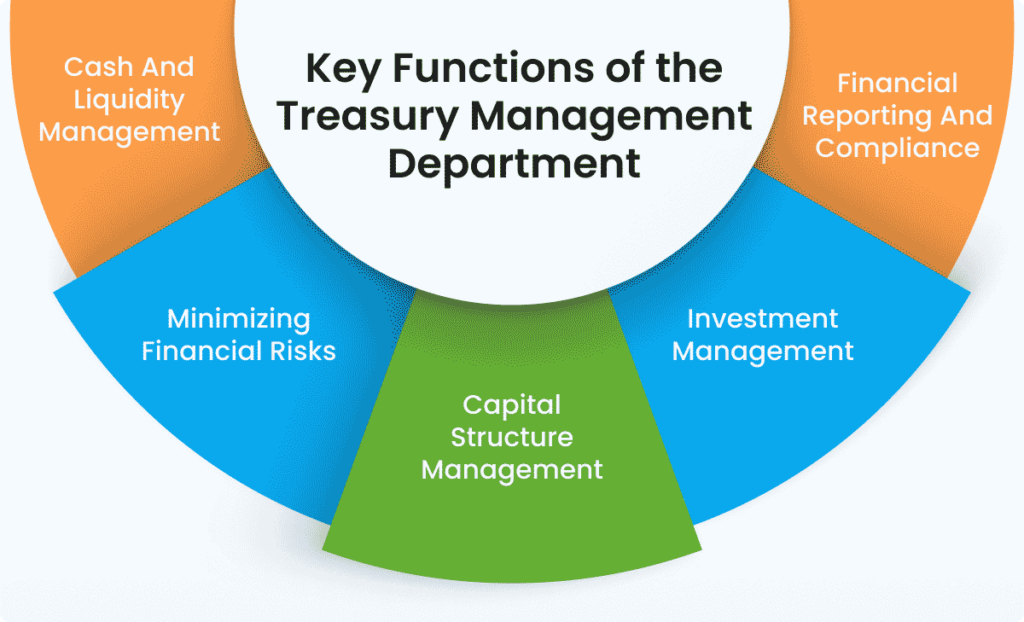

Key Features of Treasury Management Software

A robust treasury management software typically includes the following features:

- Cash and Liquidity Management: Real-time tracking of cash positions across multiple accounts and currencies.

- Risk Management: Tools for managing financial risks, such as interest rate and foreign exchange exposure.

- Payment Automation: Secure and efficient processing of domestic and international payments.

- Investment Management: Monitoring and managing investment portfolios to maximize returns.

- Financial Reporting: Generating accurate reports to support decision-making and regulatory compliance.

- Integration Capabilities: Seamless integration with ERP systems and banking platforms for a unified financial ecosystem.

Benefits of Treasury Management Software

Implementing treasury management software can deliver numerous benefits to businesses:

- Increased Efficiency: Automating financial processes reduces manual errors and accelerates operations.

- Cost Savings: By optimizing cash flow and investment strategies, companies can save significant amounts of money.

- Better Decision-Making: Access to real-time data and advanced analytics empowers businesses to make more informed financial decisions.

- Scalability: As businesses grow, treasury management software can scale to accommodate increased complexity.

- Enhanced Security: Advanced encryption and multi-factor authentication protect sensitive financial data.

Choosing the Right Treasury Management Software

Selecting the best treasury management software for your organization requires careful consideration of your specific needs. Here are some factors to keep in mind:

- Scalability: Ensure the software can grow with your business.

- User-Friendly Interface: Choose a platform that is intuitive and easy to use for your team.

- Integration: The software should integrate seamlessly with your existing systems, such as ERP or accounting software.

- Customization: Look for a solution that can be tailored to your unique financial workflows.

- Support and Training: Ensure the vendor provides robust customer support and training resources.

Real-World Applications of Treasury Management Software

From multinational corporations to small businesses, treasury management software is being used across industries to streamline financial operations. For example:

- Retail Sector: Managing cash flow during seasonal fluctuations and ensuring timely vendor payments.

- Manufacturing Industry: Optimizing working capital and managing currency exchange risks for international transactions.

- Financial Institutions: Enhancing liquidity management and ensuring regulatory compliance.

Conclusion

Treasury management software has become an indispensable tool for businesses looking to stay competitive in today’s dynamic financial landscape. By automating processes, improving risk management, and providing real-time insights, this software empowers organizations to make smarter financial decisions. Whether you’re a small business or a large corporation, investing in treasury management software can drive efficiency, enhance profitability, and position your company for long-term success.Start leveraging the power of treasury management software today and take your financial processes to the next level. With its robust features and benefits, it’s the ultimate solution for modern financial management.