Mastering Commodity Hedging: A Key Strategy for Risk Management

In today’s volatile markets, businesses that deal with commodities face significant risks due to fluctuating prices. This is where commodity hedging emerges as a powerful strategy to manage price risks effectively. By understanding the principles and benefits of commodity hedging, companies can stabilize their financial performance and protect their bottom line.

What is Commodity Hedging?

Commodity hedging is the process of using financial instruments or contracts to mitigate the risk of price changes in raw materials or goods. These financial instruments, such as futures, options, and swaps, help businesses lock in prices or manage exposure to adverse price movements. Whether you’re a producer, manufacturer, or trader, implementing a commodity hedging strategy can shield you from unexpected market fluctuations.

Why is Commodity Hedging Important?

Commodity prices are influenced by various factors, including geopolitical events, supply chain disruptions, currency fluctuations, and changing market demand. For industries heavily reliant on raw materials, even minor price swings can significantly impact profitability. Commodity hedging provides:

- Price Stability: By locking in prices, businesses can plan their budgets and operations with confidence.

- Risk Mitigation: Hedging reduces the financial impact of adverse price movements.

- Improved Decision-Making: With reduced uncertainty, companies can focus on core operations and strategic growth.

- Competitive Advantage: Stable pricing can enhance customer relationships and improve market positioning.

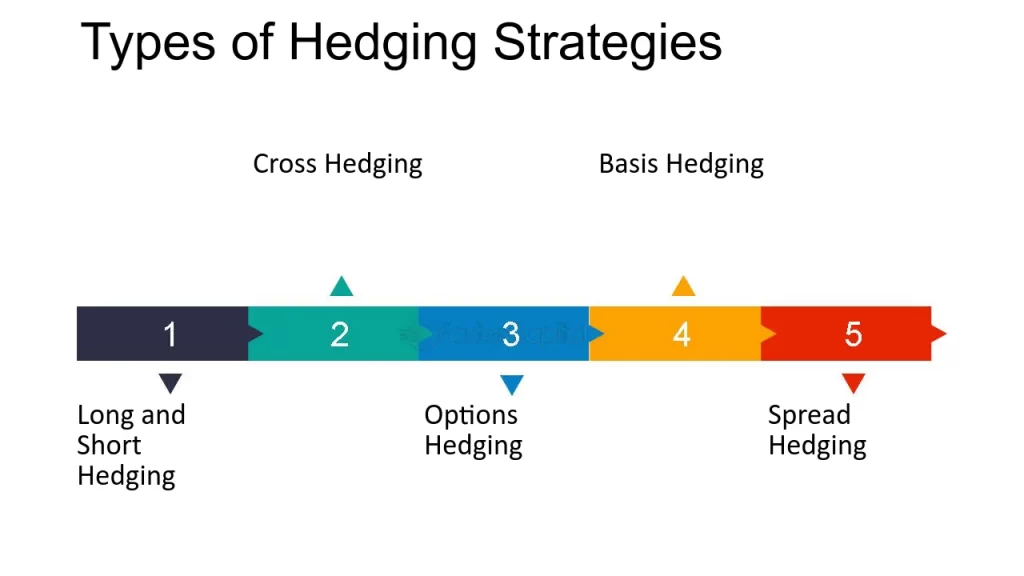

Types of Commodity Hedging Strategies

1. Futures Contracts

Futures are standardized agreements to buy or sell a commodity at a predetermined price on a specific date. They are ideal for companies looking to eliminate price uncertainty.

2. Options Contracts

Options provide the right, but not the obligation, to buy or sell a commodity at a fixed price. This flexibility makes them suitable for managing potential price changes without full commitment.

3. Swaps

Commodity swaps involve exchanging cash flows based on the price of a commodity. These are commonly used for long-term hedging needs.

4. Forward Contracts

Unlike futures, forward contracts are customized agreements between two parties to trade a commodity at a set price and date. These are more flexible but carry higher counterparty risk.

How to Implement Commodity Hedging Effectively

Implementing a successful commodity hedging strategy requires careful planning and execution. Here are the steps to follow:

- Understand Your Exposure: Identify which commodities pose the most significant risks to your business.

- Set Clear Objectives: Define what you aim to achieve with hedging, whether it’s price stability, risk reduction, or cost control.

- Choose the Right Instruments: Select financial instruments that align with your business goals and market conditions.

- Monitor the Market: Stay updated on market trends and adjust your strategy as needed.

- Engage Experts: Collaborate with financial advisors or commodity hedging specialists to ensure a well-structured approach.

Challenges in Commodity Hedging

While commodity hedging offers numerous benefits, it’s not without challenges:

- Complexity: Understanding and implementing financial instruments can be daunting.

- Cost: Hedging involves transaction costs and margin requirements.

- Market Risk: Poorly executed strategies can lead to financial losses.

- Counterparty Risk: In non-standard contracts, there’s a risk of the other party defaulting.

Addressing these challenges requires expertise, robust systems, and a commitment to continuous learning.

The Role of Technology in Commodity Hedging

Advancements in technology have made commodity hedging more accessible and efficient. Modern trading platforms offer real-time data, analytics, and automated trading tools, enabling businesses to make informed decisions. Integration with enterprise resource planning (ERP) systems ensures seamless tracking of hedging activities and financial performance.

Real-World Applications of Commodity Hedging

Industries such as agriculture, energy, metals, and manufacturing heavily rely on commodity hedging. For instance:

- Farmers use futures contracts to secure prices for their crops, ensuring stable income despite market fluctuations.

- Energy Companies hedge against volatile oil and gas prices to stabilize revenue.

- Manufacturers lock in costs for raw materials like steel or aluminum, protecting profit margins.

Conclusion

In an unpredictable market landscape, commodity hedging is an indispensable tool for businesses dealing with raw materials. By leveraging financial instruments, companies can mitigate risks, stabilize cash flows, and gain a competitive edge. While challenges exist, the benefits of a well-executed hedging strategy far outweigh the complexities.

To navigate the intricacies of commodity hedging, partnering with experts and utilizing modern technologies can make a significant difference. Embrace commodity hedging to secure your business’s future and thrive in dynamic markets.