[vc_row][vc_column][vc_column_text]With an increasing amount of electric cars what will be the impact on commodity trading market?

Will 2022 be the year that pushes electric vehicles (EVs) closer to even higher market shares?

Eelectric Vehicle sales have doubled since 2019, although they are still long behind their fossil-fueled predecessors. With many new electric vehicle models launching, the advancing technology of lithium-ion batteries, innovations of vehicle-to-grid (V2G), and huge corporate investments in EVs – the tipping point for electric vehicles may be closer than we think. Knowing this, commodity markets will undoubtedly shuffle with continued adoption of Electric Vehicles.

Below are some of the predictions on how EV’s will affect commodity markets, and insights on how to be prepared for the change.

1. The boom in lithium, cobalt, and nickel markets

With any notable increase in EV demand, Lithium, cobalt, and nickel’s small markets should spike. A supply crunch is eventually expected, Since these metals are the most commonly used in creating electric car batteries, but are limited in availability.

Metals company CleanTeQ’s CEO Sam Riggall told Bloomberg. “Getting the quantity of nickel that [electric vehicles] will need by the mid-2020s will be a challenge … with lead times often up to 10 years, investment needs to happen now.”

When will the demand for these metals spike? It is uncertain. What is certain however, is that real-time visibility into your trading operations will ensure physical and financial clarity when this volatility eventually hits market.

2. Challenges for power infrastructure

At present, most electric grids can support today’s EVs. However, as the requirement for electric vehicle charging stations continues to grow, the power infrastructure will have to adapt. For instance, nights will become the prime time for EV owners to charge their vehicles, leading to peaks in overnight power usage to become regular occurrences. Power organizations may need to find smarter ways to balance out surges. One possible idea can be for suppliers to offer incentives to those who charge their EVs during the day, taking excess low-cost energy off the grid. No matter what steps are taken to offset spikes, the patterns of power usage may need to be altered over the coming years.

Also, the rise of EVs may lead to increased demand for power in developing countries. Accordingly, countries like India and China may have to expand their generation capacities as soon as possible to match growing power consumption. Especially when existing capacities have not been sufficient to fulfill all of their needs. The pressure will be high on local distribution networks in highly populated countries with lacking infrastructure, as EV adoption increases.

3. More adhesives and sealing in e-car manufacturing

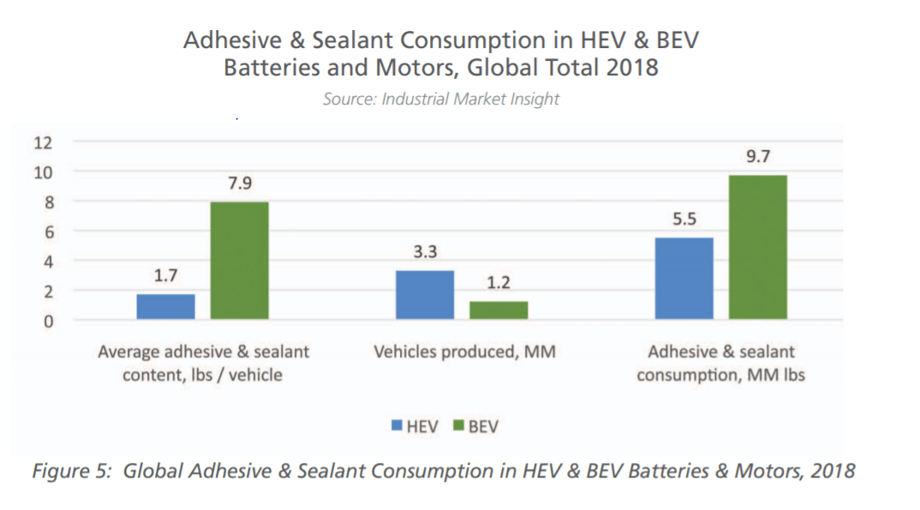

It’s astonishing how electric cars require more adhesives and sealing than internal combustion engine (ICE) cars. According to The Adhesive and Sealant Council, in the absence of engine noise, more acoustic dampening through seals is necessary to mask noises such as wind and tires. While EV’s special body structures need reinforcement solutions, heat absorbing structures around EV batteries require adhesive fixing.

The following chart shows a comparison on how battery-powered electric vehicles (BEVs) will require substantially more adhesives and sealants than hybrid electric vehicles (HEVs).

Source: The Adhesives and Sealants Council

As the adhesive and sealant industries grow, the question, ‘If there are enough manufacturers globally to handle both existing customers as well as emerging electric car manufacturers?’ still remains unanswered. The shortages of Adhesive and sealant will need to be considered and carefully handled. Also, commodity players will require comprehensive risk management to closely monitor capacity and value chain issues that may arise with the uptick in global demand for adhesives and sealants.

Tip on managing volatile commodity shifts with Robo-Commodity CTRM

Successful commodity market players will be the one’s who are prepared with the right toolset when instability strikes. Robo-Commodity, being leading CTRM solution delivers unmatched trading, risk management, logistics, and regulatory compliance solutions across commodity industries.

Learn more about how Robo-Commodity gives commodity market the right tools they need to drive smarter, faster decision-making during uncertain times. Stay ahead of inevitable shifts, as EV usage continues to grow.

Through the years we’ve supported multiple commodity traders optimize their supply chain and overall business efficiency. To learn more our Robo-Commodity, feel free to contact us today.[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column width=”1/6″][/vc_column][vc_column width=”2/3″ css=”.vc_custom_1569490505427{border: 2px solid #dd9933 !important;}”][vc_column_text]

Get a 30 Minute Free Consultation!

[/vc_column_text][contact-form-7 id=”103″][/vc_column][vc_column width=”1/6″][/vc_column][/vc_row]